“Executives speak three languages: finance, finance and finance.”

– Jeff Hiatt, Prosci Founder

Speaking finance is tough for customer experience leaders. One key reason, which I discussed last week, is that we don’t often include financial information in our survey platform, which restricts us to discussing survey metrics. And no matter how compelling the survey data is, it’s still survey data – not finance.

Why should we learn the language of finance, anyway? Few executives’ success is judged based on survey scores. They’re judged on outcomes, and those outcomes often have dollars attached to them.

Now, let’s talk about which outcomes to focus on. While costs are interesting to most, I find executives are most compelled when I discuss revenue-related metrics. Most executives (especially in sales and marketing, but also CEOs) get more excited about increasing revenue than decreasing costs, making this a good place to start.

In my book, Do B2B Better: Drive Growth through Game-Changing Customer Experience, I discuss multiple revenue-based metrics you can use, including Customer Lifetime Value, Order Velocity, and Annual Recurring Revenue. But my favorite? Net Revenue Retention.

Net revenue retention (NRR) – also called net dollar retention – combines recent customer retention with sales volume, excluding new customers’ sales. The calculation is:

Number of last year’s customers renewing this year × Average spent this year

Number of customers last year * Average spent last year

Let’s demonstrate this in an example. Say last year you had one hundred customers who spent $1,000. You lost five of them this year, and revenue stayed consistent. Your calculation would be:

95 customers (this year) × $1,000 = $95,000

100 customers (last year) × $1,000 = $100,000

Or 95 percent. Note that new customers don’t factor into this; this is strictly about retention.

To examine a different scenario, let’s say that you up-sell your remaining 95 customers by $100 on average. In that case, the calculation is:

95 customers (this year) × $1,100 = $104,500

100 customers (last year) × $1,000 = $100,000

Or 104.5 percent.

I like NRR because it directly represents the outcome of your customer experience. CX can certainly impact new sales, especially in terms of earning referrals (something I’ll discuss next week). But few organizations track referrals in a systematic way. There are strong indirect impacts. For example, one study showed that improved customer experience reduces the costs to sell; however, you’ll have a difficult time taking credit for that decreased cost to sell at your year-end review.

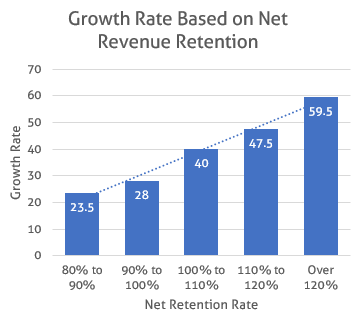

I focus more on retention and growth because they’re clearly within CX’s purview. Afterall, it’s appealing to use a metric that highlights those two outcomes. In fact, NRR is the metric we often recommend to our clients. It doesn’t work for everyone, though, such as health insurance companies that don’t offer many upsells. In this segment, it’s more effective to focus on retention only. But, NRR works well for most industries. Analysis by SaaS Capital shows a direct relationship for SaaS companies between NRR and growth, which makes sense. It’s hard to grow if you constantly need to replace your existing revenue.

My recommendation to you: own this as a metric and report on it regularly so everyone in the organization knows your NRR. If I were to ever take on a corporate CX role, this would be my first step.