Editor's Note: Take a look at our featured best practice, Cost Segregation Study: Multiple Property Class Analysis (Excel workbook). Accountants, accounting firms, and real estate property owners can all benefit from this cost segregation study (CSS) template. It makes the estimated benefit easy to figure out and has flexible assumptions for high level or detailed segregation analysis. You get a summary of cost [read more]

KPI Management: M&A Strategy KPIs

* * * *

M&A activities are integral to Strategic Planning and Performance Management, offering a pathway to achieve rapid growth, enter new markets, and acquire new technologies or capabilities.

This article dives into the core aspects of developing and implementing a successful M&A Strategy, underscored by the critical Key Performance Indicators (KPIs) that guide these decisions. We will explore how these KPIs can be leveraged by executives and senior managers to identify potential acquisition targets, evaluate the strategic fit, and ultimately, ensure the seamless integration of merged entities. The goal is to provide a blueprint for using M&A KPIs as a compass for navigating the complexities of mergers and acquisitions, ensuring that each step is aligned with the organization’s overarching strategic objectives.

Importance of M&A Strategy

M&A Strategy is more than a tactical play. It’s a strategic imperative for organizations looking to maintain a competitive edge in an ever-evolving marketplace. Through mergers and acquisitions, organizations can achieve synergies that result in increased efficiency, expanded market presence, and enhanced innovation capabilities.

However, the importance of M&A extends beyond these immediate benefits. It encompasses the strategic alignment of long-term goals, the cultural integration of merging entities, and the optimization of operational and financial performance post-merger.

Challenges to M&A and Successful Value Creation

Navigating the M&A landscape is fraught with challenges. From identifying the right targets and conducting due diligence to negotiating deals and integrating disparate organizational cultures, the process is complex and risky.

Executives and senior managers face the daunting task of making decisions that will not only impact the immediate future of their organizations but also shape their long-term strategic direction. Key challenges include ensuring strategic alignment, managing cultural integration, achieving operational synergies, and delivering on the expected value of the acquisition.

By focusing on the right KPIs, organizations can mitigate these risks, making informed decisions that maximize the benefits of M&A activities while aligning with their strategic objectives.

Top 10 KPIs for Mergers & Acquisitions Strategy

In shaping a robust M&A Strategy, certain KPIs are indispensable for guiding the process and measuring success. Here are the top 10 KPIs critical for M&A activities, selected for their broad applicability and strategic importance across industries. These KPIs are selected from the Flevy KPI Library, a robust database of over 15,000+ KPIs.

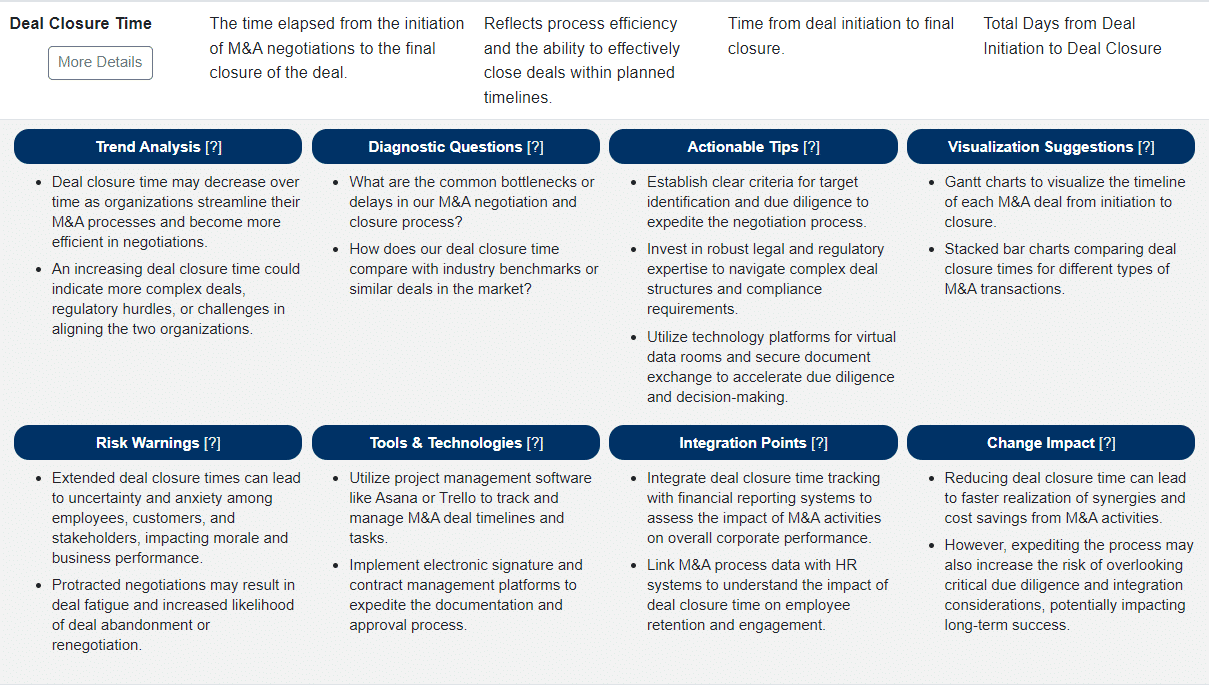

1. Deal Closure Time

- Definition: The duration from the initiation of merger or acquisition discussions to the official closure of the deal.

- Relevance: A shorter deal closure time can indicate efficient deal-making processes, minimizing operational disruptions and market uncertainty.

2. Acquisition Premium Paid

- Definition: The extra amount paid over the acquired company’s market value.

- Relevance: This KPI assesses the competitiveness and strategic importance of the acquisition, indicating how much an organization is willing to invest for strategic assets or market positioning.

3. Cost Synergies Realized

- Definition: The reduction in costs achieved by combining operations, resources, or technologies of merging entities.

- Relevance: Realizing cost synergies is crucial for justifying the investment in M&A, reflecting operational efficiency and financial integration success.

4. Revenue Synergies Realized

- Definition: The additional revenue generated from the combined capabilities and market positions of the merged entities.

- Relevance: Indicates the effectiveness of cross-selling, market expansion, and product or service enhancements post-merger.

5. Cultural Integration Effectiveness

- Definition: The degree to which the merging organizations’ cultures have been successfully integrated.

- Relevance: Essential for long-term integration success, impacting employee morale, retention, and the realization of strategic objectives.

6. Post-Merger Integration Success Rate

- Definition: The percentage of M&A deals that achieve their defined strategic, operational, and financial objectives within a set timeframe.

- Relevance: A high success rate signals effective planning, execution, and integration capabilities, critical for M&A success.

7. Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) Growth Post-M&A

- Definition: The growth in EBITDA following the completion of a merger or acquisition.

- Relevance: This KPI measures the financial impact of the M&A, indicating whether the deal has enhanced the organization’s profitability.

8. Customer Retention Rate Post-M&A

- Definition: The percentage of customers retained after the merger or acquisition.

- Relevance: High retention rates post-M&A suggest a smooth transition and effective integration of customer-facing operations and services.

9. Integration Cost Variance

- Definition: The difference between projected and actual costs incurred during the integration of merged entities.

- Relevance: Monitoring cost variance helps in managing the financial risks associated with M&A activities, ensuring that integration remains within budget.

10. Internal Rate of Return (IRR) for M&A

- Definition: The financial return generated by the M&A investment, calculated as the discount rate that makes the net present value (NPV) of all cash flows from the investment equal to zero.

- Relevance: IRR provides a clear indicator of the M&A deal’s financial performance, guiding future investment decisions and strategic planning.

To dig deeper into any of these KPIs, we invite you to explore the Flevy KPI Library, which allows you to drill down into 12 attributes for each KPI in the database. Here is an example for our top ranked KPI, Deal Closure Time:

Case Studies and Success Stories

Streamlining Synergies in a Major Tech Merger

A leading technology company acquired a smaller competitor to enhance its product offerings and market reach. The focus was on “Cost Synergies Realized” and “Revenue Synergies Realized” as key KPIs to gauge the success of the merger.

Post-acquisition, the company initiated a comprehensive integration plan aimed at consolidating operations, streamlining product development processes, and leveraging cross-selling opportunities. A dedicated team was established to monitor synergy realization, ensuring that both cost reductions and revenue enhancements were achieved as planned.

Outcome: Within the first year post-merger, the company reported a 20% reduction in operational costs and a 15% increase in revenue, attributed directly to the effective realization of synergies. These achievements surpassed initial projections, marking the merger as a significant success.

Lessons Learned: The deliberate tracking of cost and revenue synergies as KPIs provided clear targets and benchmarks for integration efforts, demonstrating the importance of focused synergy management in realizing the full potential of M&A activities.

Enhancing Cultural Integration in Cross-Border Acquisition

An international corporation acquired a regional company to expand its global footprint. “Cultural Integration Effectiveness” was identified as a critical KPI to ensure the long-term success of the acquisition, given the diverse corporate cultures and operational practices of the two entities.

The acquiring company launched an extensive cultural integration program, which included cross-cultural workshops, joint team-building activities, and the establishment of a cross-company integration task force. This program was designed to align values, operational norms, and business practices.

Outcome: The effectiveness of the cultural integration efforts was evident in the high employee retention rates and positive feedback from staff surveys conducted one year after the merger. The successful blending of cultures facilitated a smoother operational integration and contributed to achieving strategic objectives ahead of schedule.

Lessons Learned: Prioritizing cultural integration as a key component of post-merger integration can significantly impact the overall success of M&A activities. Dedicated programs and clear KPIs around cultural integration are essential for maintaining morale and productivity through the transition.

Additional Resources and Further Reading

Foremost, if you are in the process of selecting or refreshing your Corporate Strategy KPIs, take a look at the Flevy KPI Library. With over 15,000+ KPIs, our KPI Library is one of the largest databases available. Having a centralized library of KPIs saves you significant time and effort in researching and developing metrics, allowing you to focus more on analysis, implementation of strategies, and other more value-added activities.

Here are other KPI Strategy and KPI Management articles we’ve published:

- Principles of KPI Selection. This article breaks down the 8 guiding principles to KPI selection and provides several case studies on how to use these principles in practice.

- Principles of KPI Maintenance. It’s important to recognize that as market conditions and strategic objectives evolve, so too must the KPIs. This article provides a disciplined approach to maintaining KPIs.

- KPI Dashboard Design & Visualization. Learn the art and science of designing KPI dashboards, including types of data visualization and how to choose among them.

- Anatomy of a Strong KPI. Learn what makes a KPI effective, discussing the characteristics of KPIs that are most impactful and how they can drive strategic business decisions.

- 10 Common Pitfalls in KPI Implementation. Learn how to identify and remediate the 10 most common pitfalls in KPI implementation. If left unfixed or as unknowns, these pitfalls can have disastrous, long-term impacts on the organization.

- KPIs and Organizational Alignment . This article discusses the concepts of strategic, tactical, and operational KPIs; as well as balancing individual, team, and organizational objectives.

- Integrating KPIs into Employee Performance. This article discusses 5 methods for integrating KPIs into individual performance metrics; and includes several case studies.

- Integrating KPIs into the Organizational Culture. This article breaks down 4 strategies for embedding KPIs into the Corporate Culture; also includes several case studies.

- Future-Proofing KPIs. Understand how to “future-proof” KPIs by understanding the impacts of emerging market trends, emerging technologies, and evolving consumer behaviors on KPIs.

- KPIs and Digital Transformation. All organizations are undergoing Digital Transformations. Learn how to define, select, and implement relevant Digital Transformation KPIs.

Do You Want to Implement Business Best Practices?

You can download in-depth presentations on 100s of management topics from the FlevyPro Library. FlevyPro is trusted and utilized by 1000s of management consultants and corporate executives.

For even more best practices available on Flevy, have a look at our top 100 lists:

- Top 100 in Strategy & Transformation

- Top 100 in Digital Transformation

- Top 100 in Operational Excellence

- Top 100 in Organization & Change

- Top 100 Management Consulting Frameworks

These best practices are of the same as those leveraged by top-tier management consulting firms, like McKinsey, BCG, Bain, and Accenture. Improve the growth and efficiency of your organization by utilizing these best practice frameworks, templates, and tools. Most were developed by seasoned executives and consultants with over 20+ years of experience.

Readers of This Article Are Interested in These Resources

|

|

145-slide PowerPoint presentation

|

|

Excel workbook

| |||

About Flevy Management Insights

Top 10 Recommended Documents