Limited Partnerships: Their Structure, Value, & Practical Examples

Hubspot Sales

SEPTEMBER 1, 2021

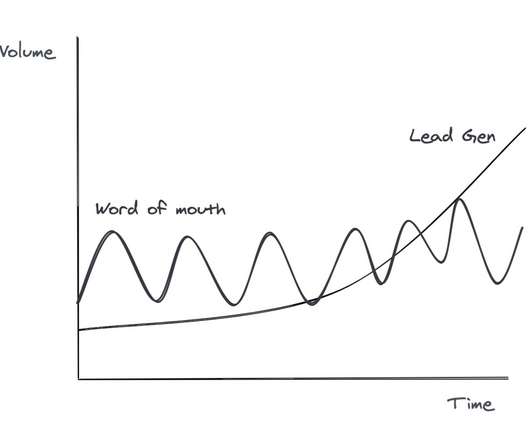

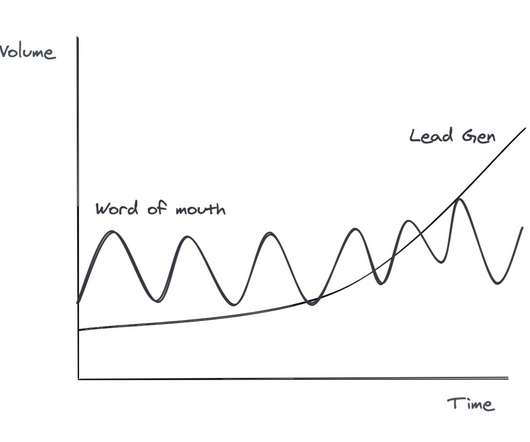

A limited partnership is a business model that can connect bold, enterprising entrepreneurs with savvy investors looking to finance lucrative, low-touch business ventures. Limited partnerships (LPs) have a place in a variety of industries — particularly ones that involve time-bound projects. Limited Partnership vs. LLC.

Let's personalize your content