THE 10-K FILING: THE MOST IMPORTANT DOCUMENT THAT SAMS NEVER READ

Strategic Account Management Association

APRIL 5, 2021

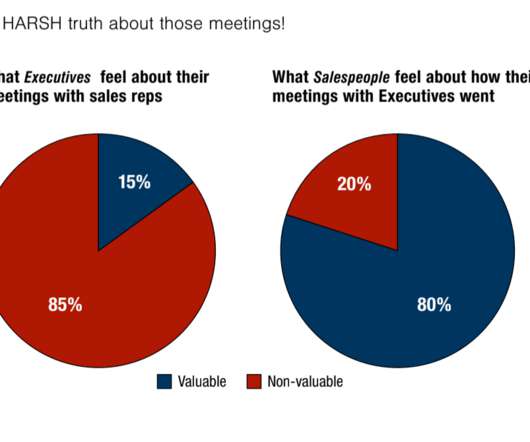

1 In fact, many of them admit their meetings were a total waste of time. is that, in the same study, 80 percent of these same sales reps actually believe they’ve had a successful meeting!2 So how do I judge if MY meeting with an executive was successful?”. It means they didn’t prepare for a CXO meeting.

Let's personalize your content