Capabilities-driven M&A

Flevy

JANUARY 11, 2022

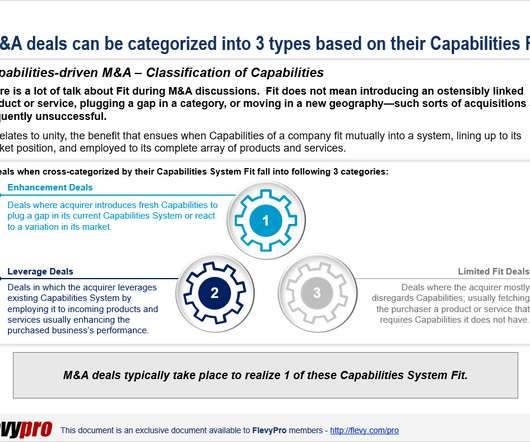

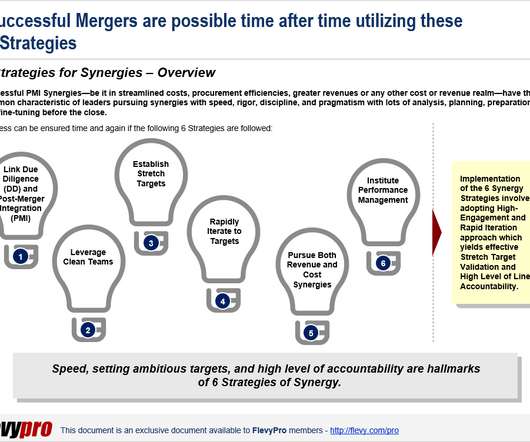

Mergers and Acquisitions (M&A) generally do not produce the outstanding results that they are envisioned and purported to provide. Capabilities-driven M&A have managed to raise shareholder value for the acquirer despite the tough years since the economic crisis of the 2000s.

Let's personalize your content