Startup Due Diligence: What it Is & Why it Matters

Hubspot Sales

MAY 29, 2024

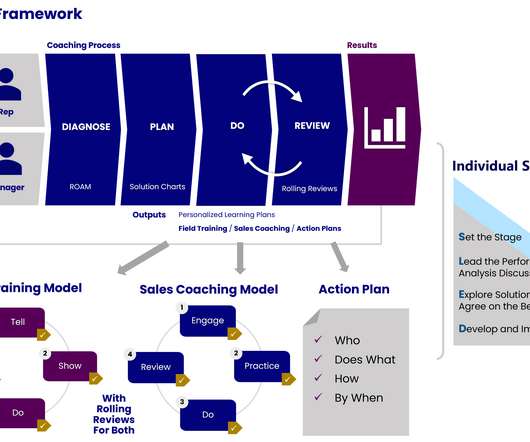

Even small disagreements can come to light during the startup due diligence process when investors look into your company before deciding to invest their money. Examining Your Organizational Structure and Processes One important aspect for investors to analyze is how your company currently runs.

Let's personalize your content