6 Ways to Get Your Business "Investor Ready"

Hubspot Sales

MARCH 22, 2022

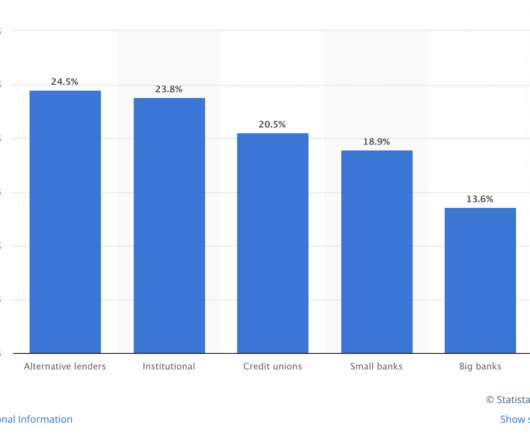

Now it's time to find investors to get it off the ground. Whether you're funding a side gig or the next big startup , you can find the right investors to help your business scale. Here, we'll discuss where to find investors and six strategies to get your business "investor ready.". Here are a few types of investors: 1.

Let's personalize your content